How Might President Biden's Tax Plan Affect Me?

Taxes. Everyone’s favorite topic! With the extended 2020 tax filing deadline approaching, some are wondering how their taxes might look next year, and the years to follow, with Biden’s proposed tax plan.

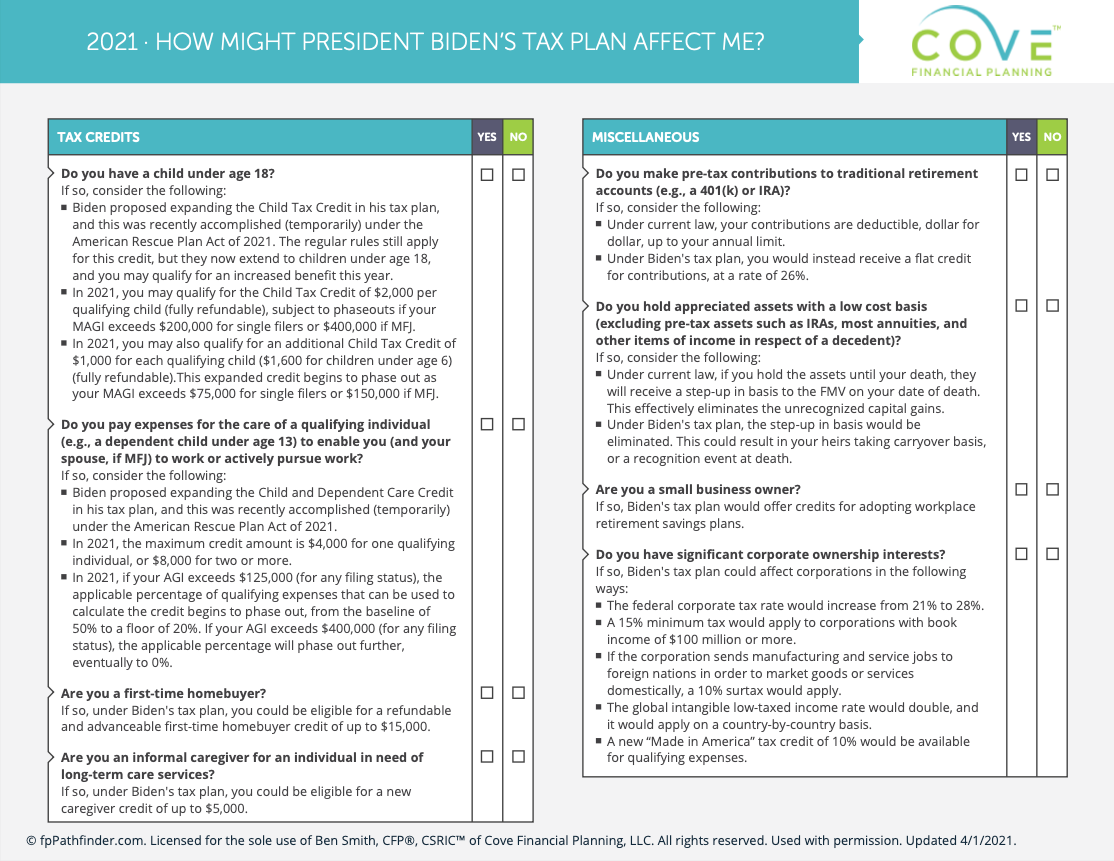

The Biden administration has outlined a tax proposal that focuses on raising taxes on corporations and wealthy households, while increasing credits for moderate- to lower-income households. With Democratic control of Congress, changes outlined in the tax plan have an increased possibility of becoming reality. Though, nothing has been set in stone yet, below is a checklist and summary of the main takeaways for most families.

The Good News

First-time homebuyer benefits

You could be eligible for a credit of up to $15,000 for a first-time home purchase under Biden’s plan. Instead of waiting until you file your taxes next year, you can receive the credit at the time of your purchase to help with the down payment.

Expanded tax credits for kids

Biden has proposed expanding the Child Tax Credit of $2,000 per year for each qualifying child, if your income is under $200,000 (single filers) or $400,000 (joint filers). The more kids you have, the better!

Expanded tax credits for childcare

Biden has also proposed expanding the Child and Dependent Care Credit of $4,000 for one qualifying individual and $8,000 for two or more qualifying individuals. Daycare is unforgivably expensive, and this credit will help families with two working spouses.

Informal caregiver benefits

If you are an informal caregiver for someone in need of long-term care services—such as a parent or grandparent—you could be eligible for a new caregiver credit of up to $5,000.

Student loan forgiveness

The Biden tax plan would provide some tax relief for the burden of student debt, in addition to adding more generous forgiveness and payment-deferral rules for present student loan programs. The program would forgive the balance of a borrower’s outstanding student loan debt after 20 years without imposing any tax liability.

The Bad News

More taxes on high earners

If you earn more than $400,000 per year, your federal Income tax rate could go up. On top of that, the Biden plan would also impose an additional Social Security payroll tax of 6.2% (on each the employer and the employee) on all earned income of $400,000 or more.

Changes to pre-tax 401(k) and IRA contributions

The proposed tax plan includes a potential substitute for retirement plan tax deductions (dollar-for-dollar) to a flat tax credit (up to 26%). This may be beneficial to lower-income earners, but higher earners in a high federal tax bracket would lose. For example, if the proposed revision of the 401(k) contribution benefit entitled a taxpayer with a marginal tax rate of 35% to a 20% tax credit, instead of the current tax deduction, the tax savings for the maximum annual contribution of $19,500 into a 401(k) plan would decline from $6,852 to $3,900.

Inheritance taxes going up

Under current law, if you pass away with appreciated assets, your heir(s) do not need to pay taxes on the gains. For example, if you own $200,000 worth of Apple stock, and you paid just $10,000 for it in the 1990s (nicely done!), your heirs do not need to pay taxes on the $190,000 in gains when you pass away. Biden’s plan eliminates this cost basis “step up,” so your heirs may be on the hook for a big tax bill if they inherited your assets at a gain and sell that Apple stock.

In short, if you are growing a family and incurring childcare expenses while making student loan payments, you’re probably pretty excited about the tax proposal. If, on the other hand, you earn a lot of money, save aggressively into your retirement accounts and plan on leaving your assets to family heirs, you may benefit from updating your financial plan to avoid some of the impact of the potential tax hikes.

If you want to learn about how Biden’s tax plan might impact you, reach out to me at Ben@coveplanning.com or schedule a free consultation call.

Sign up for Cove’s Build Your Wealth Newsletter to stay informed with the latest personal finance insights!

Ben Smith is a fee-only financial advisor and CERTIFIED FINANCIAL PLANNER™ (CFP®) Professional with offices in Milwaukee, WI, Evanston, IL and Minneapolis, MN, serving clients virtually across the country. Cove Financial Planning provides comprehensive financial planning and investment management services to individuals and families, regardless of location, with a focus on Socially Responsible Investing (SRI).

Ben acts as a fiduciary for his clients. He does not sell financial products or take commissions. Simply put, he sits on your side of the table and always works in your best interest. Learn more how we can help you Do Well While Doing Good!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Ben Smith, and all rights are reserved. Read the full Disclaimer.