Life Events

New Job

What issues should I consider when starting a new job?

Buying A Home

What issues should I consider when buying a home?

Starting a Business

What issues should I consider when starting a business?

Job Loss Related Issues

What issues should I consider if I lose my job?

Refinancing Mortgage

What issues should I consider when thinking about a mortgage refinance?

Having A Child

What issues should I consider when having/adopting a child?

Job Promotion/Raise

What issues should I consider if I get a promotion or raise at work?

Sudden Wealth Event

What issues should I consider if I experience a sudden wealth event?

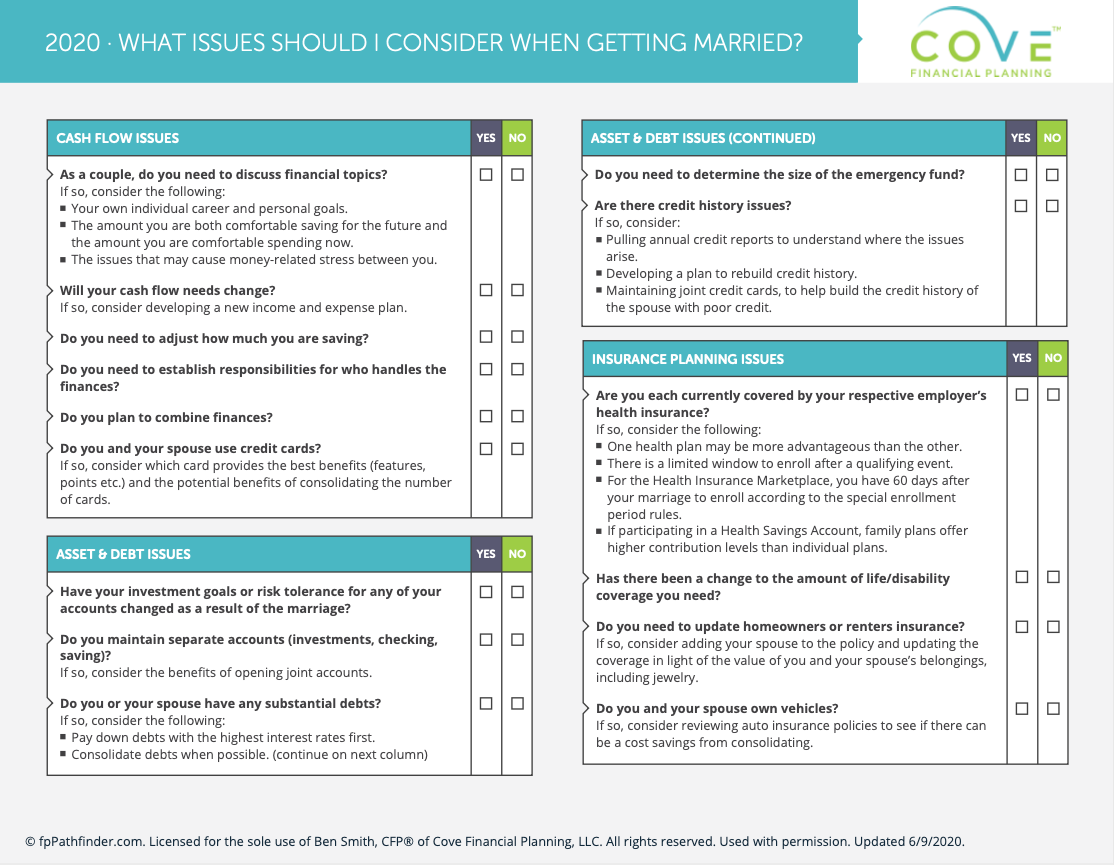

Getting Married

What issues should I consider when getting married?

Divorce-related Issues

What issues should I consider during my divorce?

Investing

Market Downturn

What issues should I consider in a recession or market correction?

529 Plan Distribution Rules

Is the distribution from my 529 plan taxable?

Where to Save

What accounts should I consider saving into?

Important Numbers

Quick reference and annual limits.

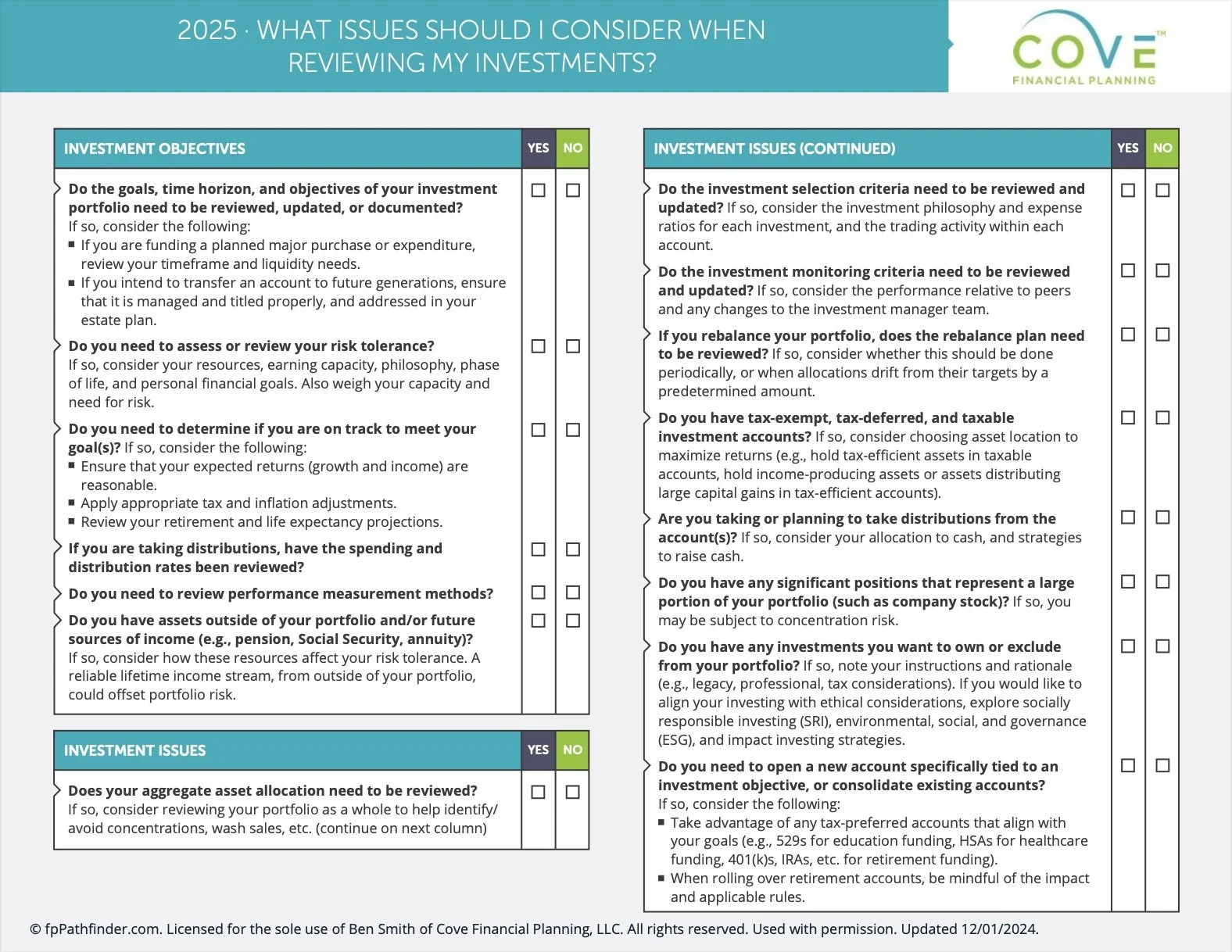

Issues to Consider When Reviewing My Investments

Steps for periodically reviewing your investment portfolio.

401(k) Rollover Considerations

Should I rollover my old 401(k) into an IRA?

Traditional IRA Contribution Rules

Can I make a deductible contribution into my Traditional IRA?

Roth vs. Traditional IRA Contribution

Should I contribute into my Roth IRA or my Traditional IRA?

Roth iRA Contribution Rules

Can I contribute to my Roth IRA?

Retirement

Social Security

Will my Social Security benefit be reduced?

RMD Rules for INherited IRAs

Can I delay the Required Minimum Distributions (RMDs) on my Inherited Traditional IRA?

Retirement Issues

What issues should I consider before I retire?

Social Security & Divorce

Am I eligible for Social Security if I’m divorced?

Taxes

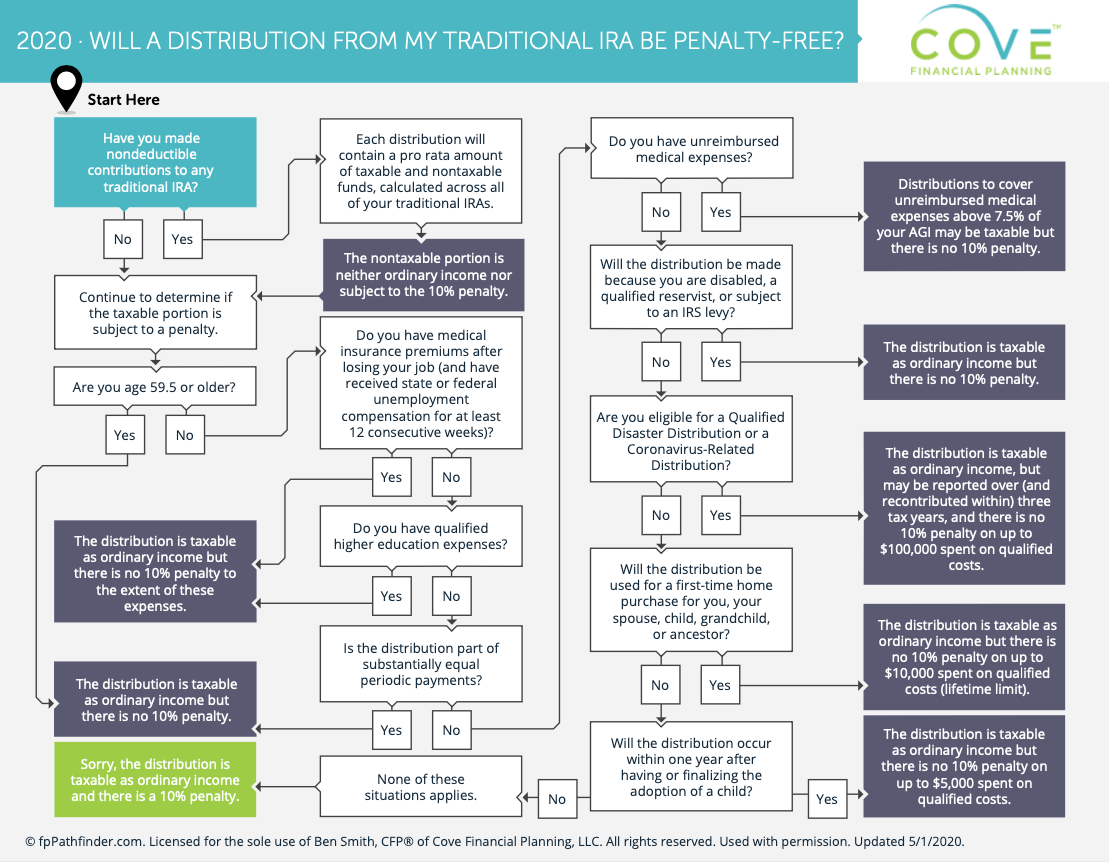

IRA Conversion Rules

Will my Roth IRA conversion be penalty-free?

ESPP Taxation Rules

Will I have to pay tax on my qualified Employee Stock Purchase Plan (ESPP)?

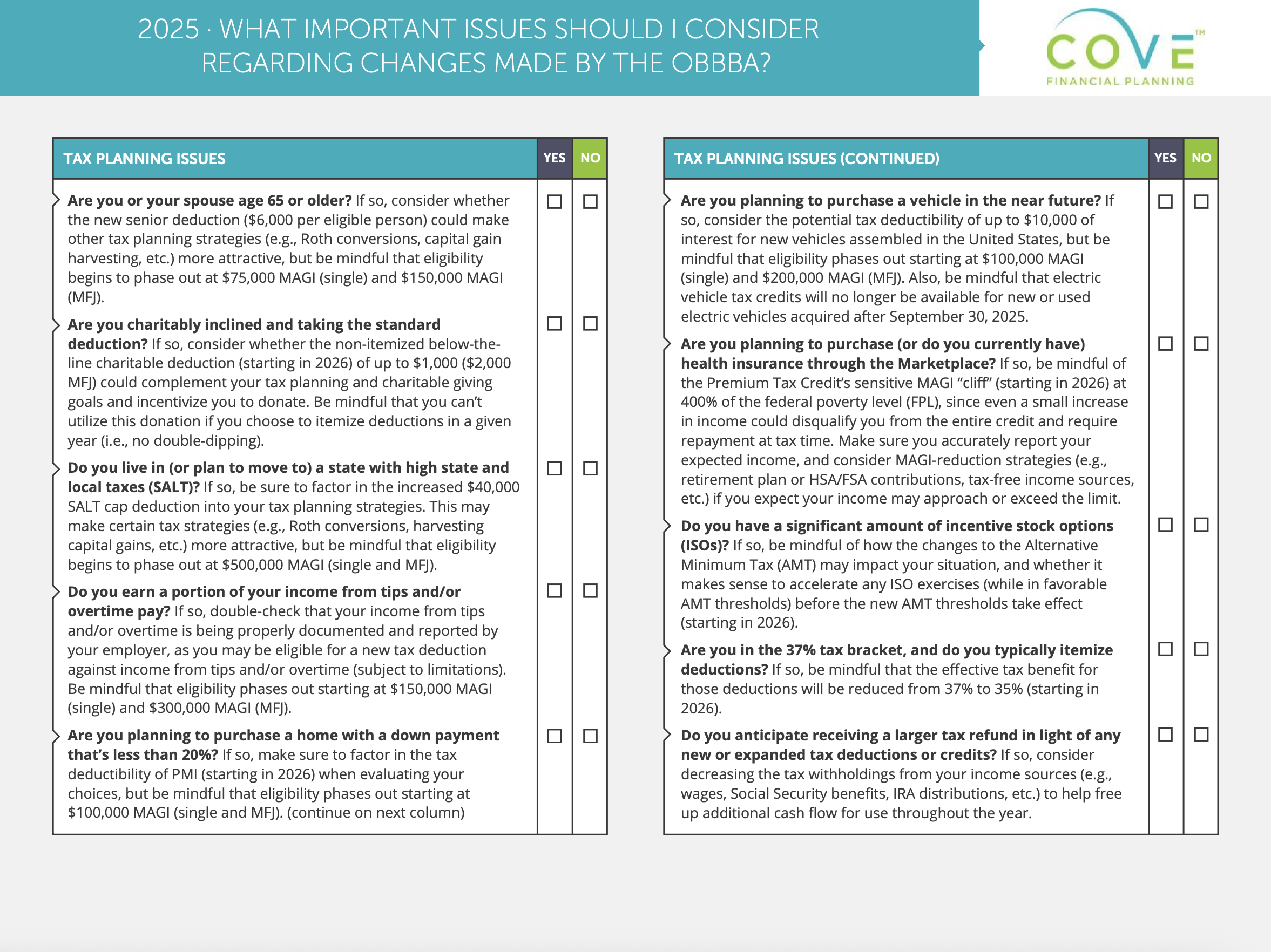

One Big Beautiful Bill Act (OBBBA) Tax Changes

What issues will I need to consider with the OBBBA tax changes?

Basis on Inherited Property

Will I receive a step-up in basis on my inherited property?

Tax Return Analysis (Employed)

As someone who is working, what issues should I consider when reviewing my tax return?

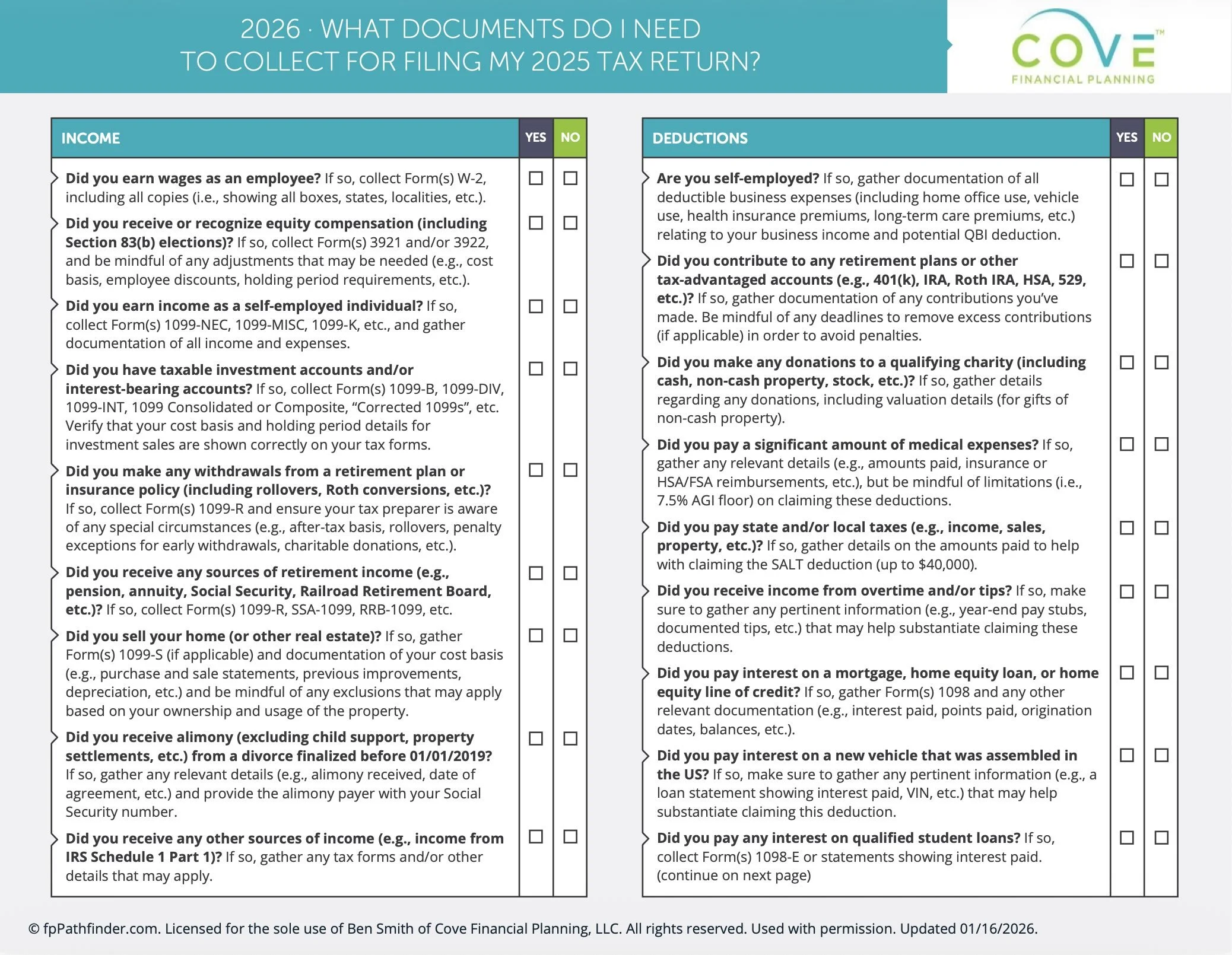

2025 Tax Return Documents Checklist

What documents will I need for my 2025 tax-return filing?

Basis on Gifted Property

Will I receive a step-up in basis on my gifted property?

Tax Return Analysis (Retiree)

As a retiree, what issues should I consider when reviewing my tax return?

Tax Impact on the sale of an investment

Will I have to pay tax on the sale of my investment?

QBI Deduction Rules

Am I eligible for a qualified business income deduction?

Estate Planning

Insurance & Healthcare

Health & Life Insurance

What issues should I consider when reviewing my health and life insurance policies?

Health insurance options with an early retirement

If I retire early, should I buy health insurance through the Health Insurance Marketplace?