New Retirement Rules in 2023

After months of debate, Congress finally passed some major changes to retirement laws at the end of 2022. While many of the changes will roll out over the next few years, some of them take effect right away.

These new laws follow the retirement-rule changes set in the original SECURE Act in 2020.

Read on for the biggest retirement-rule changes in the SECURE Act 2.0 for 2023.

1. Required Minimum Distribution (RMD) age increasing

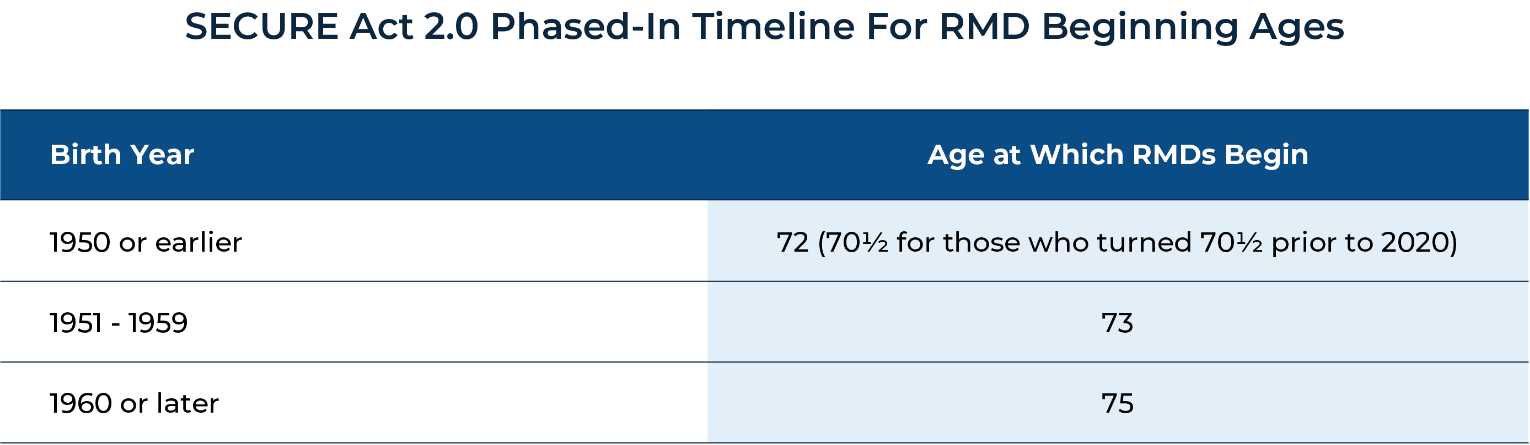

This change only impacts folks born between 1951 and 1959.

If you turned 72 in 2022 or earlier, you will need to continue taking RMDs as scheduled.

If you're turning 72 in 2023, and have already scheduled your withdrawal, you might consider updating your withdrawal plan.

The SECURE 2.0 also pushes the age at which RMDs must start to 75 starting in 2033.

The IRS site explains commonly asked questions about RMDs.

2. The penalty for missing an RMD decreasing to 25% in 2023

This is a big decrease from the previous 50% penalty for not taking your RMD. In addition, if you correct a past-due RMD and pay taxes on it within two years, the penalty drops to 10%.

3. More options with Qualified Charitable Distributions (QCDs)

Starting in 2023, folks over the age of 70½ can gift a one-time amount of $50,000 (adjusted for annual inflation) to a:

Charitable Remainder Unitrust (CRUT)

Charitable Remainder Annuity Trust (CRAT), or a

Charitable Gift Annuity (CGA)

In other words, QCDs can be made to additional vehicles beyond going straight to charities. As a reminder, these count towards your RMD each year.

4. Roth savings get a boost

Starting in 2023, employers can offer to make matching contributions directly into their Roth account, where they’ll grow tax-free.

So, if you are making Roth 401(k) contributions, for example, your employer’s match might not necessarily be made into your Traditional 401(k). This may result in even more money being piled into your Roth 401(k) each year, growing your after-tax retirement savings more quickly.

In addition, RMDs will no longer be required from Roth 401(k)s.

Finally, Roth contributions to SIMPLE and SEP IRAs will be allowable beginning this year, however, we'll need to wait for the IRS (and custodians like TD Ameritrade and Betterment) to roll out these new account apps before we can take advantage of these new opportunities.

5. 529 plan rollovers into Roth IRAs

If your child does not need his/her 529 plan for any reason, you can rollover their balance (up to $35,000) into a Roth IRA in his/her name. This does not go into effect until 2024.

There are a few requirements that must be met, including:

The Roth IRA must be in the name of the 529 plan beneficiary (i.e. your child)

The 529 plan must have been open for at least 15 years

Account holders cannot roll over contributions (or earnings) made in the last 5 years

In addition to the $35,000 maximum, annual limits for the rollover would have to be within the annual contribution limit ($6,500 in 2023), so you couldn’t complete a full $35,000 allowable rollover in a single year.

Check out this CNBC article explaining more details about this new 529 plan to Roth IRA rollover rule.

6. More favorable early distributions from retirement accounts without penalty

Starting in 2023, victims of disasters and folks who are terminally ill can access their retirement accounts early without incurring a 10% penalty.

Do you want to talk about how these rules affect your retirement plan? Reach out to me at Ben@coveplanning.com or schedule a free consultation call.

Sign up for Cove’s Build Your Wealth Newsletter to stay informed with the latest personal finance insights!

Ben Smith is a fee-only financial advisor and CERTIFIED FINANCIAL PLANNER™ (CFP®) Professional with offices in Milwaukee, WI, Evanston, IL and Minneapolis, MN, serving clients virtually across the country. Cove Financial Planning provides comprehensive financial planning and investment management services to individuals and families, regardless of location, with a focus on Socially Responsible Investing (SRI).

Ben acts as a fiduciary for his clients. He does not sell financial products or take commissions. Simply put, he sits on your side of the table and always works in your best interest. Learn more how we can help you Do Well While Doing Good!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Ben Smith, and all rights are reserved. Read the full Disclaimer.