U.S. Debt Ceiling and Market Returns

The U.S. debt ceiling is all over the news, and many investors are concerned about the impact on the stock market and economy.

What exactly is the debt ceiling?

The debt ceiling basically limits how much the federal government can borrow.

The current debt limit of $31.4 trillion was hit in January 2023, and the Treasury has estimated that the date in which the government will no longer be able to meet its obligations—aka the X-Date—could be as soon as this summer.

What’s going on now?

Congress is now working to increase the debt ceiling so the government can meet its obligations.

Both Republicans and Democrats are hoping to get a little somethin’ from the other side in their negotiations over the debt limit.

Surely, the economy would be negatively impacted if the debt ceiling is not lifted.

We’ve been here before

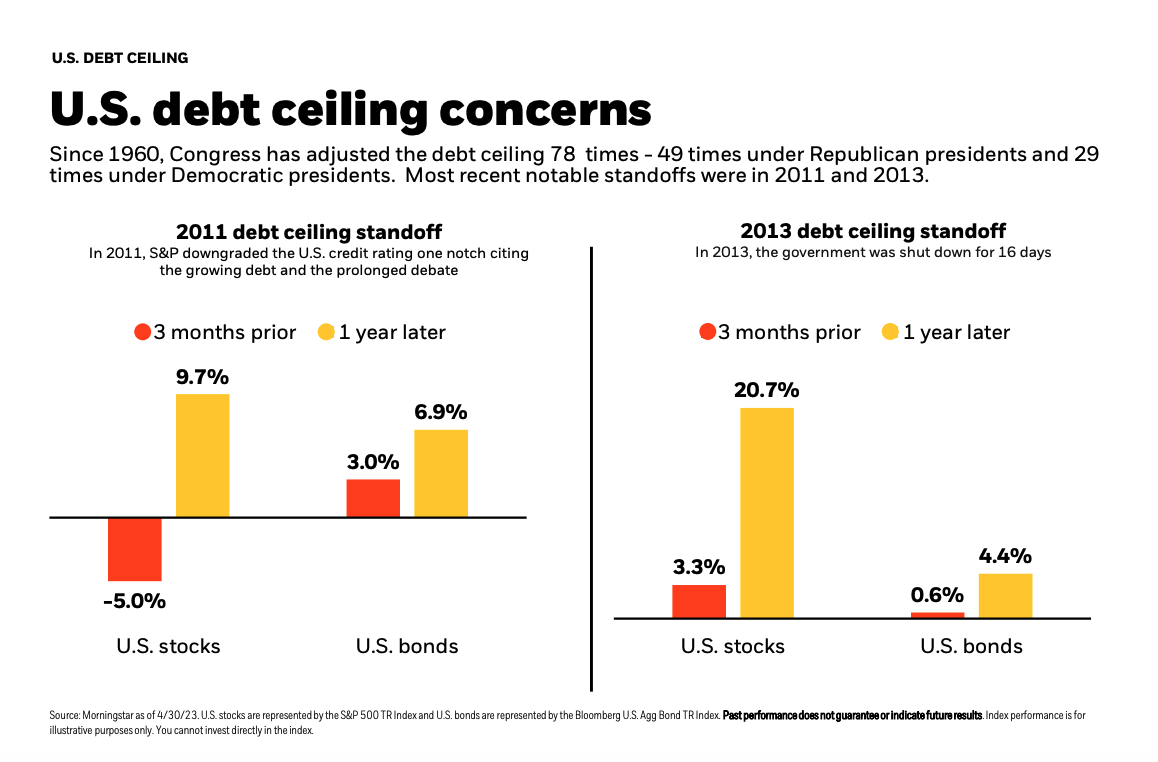

That said, this isn’t our first rodeo. In fact, Congress has adjusted the federal debt ceiling a whopping 78 times since 1960!

49 times under Republic presidents

29 times under Democratic presidents

Two of the most recent debt-ceiling adjustments took place In 2011 and 2013.

In 2011, S&P downgraded the U.S. credit rating one notch citing the growing debt and the prolonged debate.

In 2013, you might remember that the government was shut down for 16 days amidst stalled negotiations for a debt-ceiling increase.

Interestingly, the U.S. stock and bonds markets performed pretty well before and even after the more recent 2011 and 2013 debt-ceiling standoffs.

In short, the markets don’t really care about the U.S. debt ceiling. Long-term investors have always been rewarded by investing early and often and staying the course - I don’t think this time is any different.

Do you have questions about how to manage your investment portfolio? Reach out to me at Ben@coveplanning.com or schedule a free consultation call.

Sign up for Cove’s Build Your Wealth Newsletter to stay informed with the latest personal finance insights!

Ben Smith is a fee-only financial advisor and CERTIFIED FINANCIAL PLANNER™ (CFP®) Professional with offices in Milwaukee, WI, Evanston, IL and Minneapolis, MN, serving clients virtually across the country. Cove Financial Planning provides comprehensive financial planning and investment management services to individuals and families, regardless of location, with a focus on Socially Responsible Investing (SRI).

Ben acts as a fiduciary for his clients. He does not sell financial products or take commissions. Simply put, he sits on your side of the table and always works in your best interest. Learn more how we can help you Do Well While Doing Good!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Ben Smith, and all rights are reserved. Read the full Disclaimer.